September 3, 2014, Vancouver, BC – Wellgreen Platinum Ltd. (TSX-V: WG; OTC-QX: WGPLF) is pleased to announce the results of its recent metallurgical testing and the comprehensive review and assessment of earlier metallurgical test programs from its Wellgreen PGM-Ni-Cu project, located in the Yukon Territory, Canada. Testing in 2013 and 2014 completed by SGS Lakefield Research Limited (SGS) and XPS Consulting & Test work Services (XPS), a unit of GlencoreXstrata, along with previous studies undertaken by SGS and G&T Metallurgical Services Ltd (G&T), included batch and locked-cycle testing on 195 drill core samples from across the main Wellgreen resource area.

Highlights:

- Metallurgical testwork using conventional flotation shows improved recoveries for all major metals versus the 2012 Preliminary Economic Assessment, including increases of 35% for platinum and 13% for nickel

- Results indicate potential production of a high-value bulk nickel-copper-PGM concentrate with grades of 6-10% nickel and 8-12% copper with 11-14 g/t 3E (platinum, palladium and gold) plus an additional 1-4 g/t of rare PGMs (rhodium, iridium, osmium and ruthenium)

- Improved conventional flotation metal recovery was attained through:

- – Identification of three major geologic and metallurgical domains with differing response characteristics

- – Optimization of grind size, reagent selection, pH and conditioning time for each domain

- – Use of a magnetic separation process with re-grinding of magnetic material for some domains

- Testing included bulk flotation processes, sequential flotation and bulk separation to produce individual high quality nickel and copper concentrates, which will be assessed further in the future

- Additional secondary recovery processes have also been identified which could increase extraction of the unrecovered PGM material

These new metallurgical test results are the second major milestone for completion of the 2014 Wellgreen Preliminary Economic Assessment (PEA) and follow upon the recently updated Wellgreen mineral resource estimate of July 2014. Wellgreen Platinum is fully-funded for completion of the PEA and for initiation of Pre-feasibility level studies, which will commence with a drilling program scheduled to begin in September.

The metallurgical test programs were designed to increase confidence in the metal recovery process for the Wellgreen mineralization. Based on the new test results and the comprehensive review of previous metallurgical test programs on the Wellgreen project, the Company anticipates that the proposed conventional sulphide flotation process will result in improvement in the overall average recovery for all major metals as compared to the 2012 PEA, particularly for the platinum group metals and nickel. This analysis was based on 183 batch samples and 12 locked-cycle tests (LCTs) for the three major metallurgical domains – Gabbro / Massive Sulphides, Clinopyroxenite / Pyroxenite, and Peridotite – that investigated bulk concentrates, sequential flotation, bulk concentrate separation and magnetic separation processes, some of which produced separate nickel and copper concentrates.

Table 1 – Estimated Metal Recoveries by Geologic Domain

|

Geological

Domain

|

Recovery to Bulk Concentrate %

|

|

Ni

|

Cu

|

Co

|

Pt

|

Pd

|

Au

|

|

Gabbro & Massive

Sulphides

|

83%

|

95%

|

68%

|

75%

|

81%

|

70%

|

|

Clinopyroxenite / Pyroxenite

|

75%

|

88%

|

64%

|

59%

|

73%

|

66%

|

|

Peridotite

|

68%

|

66%

|

55%

|

58%

|

58%

|

59%

|

Recoveries shown for the three domains are normalized to a bulk concentrate grade containing 6% nickel

With the completion of these metallurgical studies, the Company will now move to finalize the mine modelling that will form the basis for the 2014 PEA. This modelling will focus on the extraction of the higher grade Gabbro/Massive Sulphides and Clinopyroxenite/Pyroxenite domains, with Peridotite material being stockpiled for future processing. Dunite material was specifically excluded from the resource model.

On this basis, the concentrates produced are anticipated to grade 6-10% nickel with 8-12% copper and 11-14 g/t 3E (platinum, palladium and gold) plus an additional 1-4 g/t of rare PGMs rhodium, iridium, osmium and ruthenium (these exotic PGMs were also reported in historical production records). The blended recovery for these two main domains is estimated to be approximately 77% Ni, 89% Cu, 64% Co, 62% Pt, 75% Pd and 67% Au. This represents an increase in the net recovery for all major metals as compared to the 2012 PEA, with platinum and nickel recoveries increasing by approximately 35% and 13% respectively.

Table 2 – Estimated Concentrate Grades and Blended Recoveries in Primary Target Geologic Domains

|

Concentrate Grades

|

Nickel

|

Copper

|

PGM+Au

|

Exotic PGMs

|

|

6-10%

|

8-12%

|

10-14g/t

|

+1-4g/t

|

| 2014 Blended Recoveries* |

Ni

|

Cu

|

Co

|

Pt

|

Pd

|

Au

|

|

77%

|

89%

|

64%

|

62%

|

75%

|

67%

|

|

2012 PEA Recoveries

|

68%

|

88%

|

64%

|

46%

|

73%

|

59%

|

|

|

|

|

|

|

|

|

|

|

*Gabbro/Massive Sulphides and Clinopyroxenite/Pyroxenite domains

Greg Johnson, Wellgreen Platinum President & CEO states, “These new results clearly show that a high quality, smelter grade bulk concentrate can be produced from the Wellgreen mineralized material at high levels of recovery using conventional sulphide flotation. In addition, the high levels of platinum group metals and gold in these concentrates have potential to add substantially to their commercial value along with the nickel and copper. Based on our review of other commercial bulk nickel concentrates and smelting contracts, the Company and its concentrate marketing consultants believe that such a bulk concentrate is likely to have strong interest from multiple existing smelters.”

Mr. Johnson continues, “Early on, we recognized the potential to enhance metallurgical performance by pursuing certain opportunities presented in the 2012 PEA. The metallurgical team, which has significant experience at the Raglan and Sudbury districts in Canada, as well as other similar deposits globally, has made great strides in the understanding of the geology, mineralogy and metallurgy at the Wellgreen PGM-Ni-Cu project over the past two years. In particular, the recognition of the importance of the individual major metallurgical domains for recovery optimization and the addition of the magnetic separation process to the flowsheet. Based on the work with XPS and SGS labs, the Wellgreen mineralized material shows excellent metallurgical response that is typically above that observed in other similar grade deposits documented in their global databases. The studies have also highlighted a number of opportunities for further improvement in metal recovery that will be pursued as part of our next round of studies for the Pre-feasibility program. The results of this thorough metallurgical testing along with the recent major expansion of the pit constrained resources make Wellgreen one of the most exciting mid-stage development projects in the platinum group metals sector. Wellgreen has become one of the largest known undeveloped PGM resources, with over 5.5 million ounces of M&I 3E (platinum+palladium+gold) resources and an additional 13.8 million ounces of 3E resources in the Inferred category with significant co-occurring nickel, copper and cobalt.”

Metallurgical Testing Details

Laboratory scale testing in 2013 and 2014 was performed by SGS and XPS under the supervision of the Company’s independent metallurgical Qualified Person, John Eggert, P.Eng., of Eggert Engineering Inc. with review and consultation by Dr. David Dreisinger of the University of British Columbia. The metallurgical test programs were designed to refine the process flowsheet and to improve recovery levels, particularly for the PGMs that are contained within saleable concentrates. These test programs evaluated the effect of factors such as grind size, pH, conditioning, the use of various collectors, flotation reagents, dispersants and depressants on mineral recoveries and concentrate grades, magnetic separation and modifications to the mineral processing flowsheet.

One of the key observations from this assessment was that the optimization of sulphide flotation recovery varied based on the three major geological domains. In general, the recovery of economic metals is highest from the Gabbro/Massive Sulphides domain, followed by the Clinopyroxenite/Pyroxenite and then by the Peridotite. Testing has shown that the material from each domain can be processed in the same circuit with variances related to grind size, conditioning time, pH and the use of magnetic separation with the majority of reagent selection applied across all the domains.

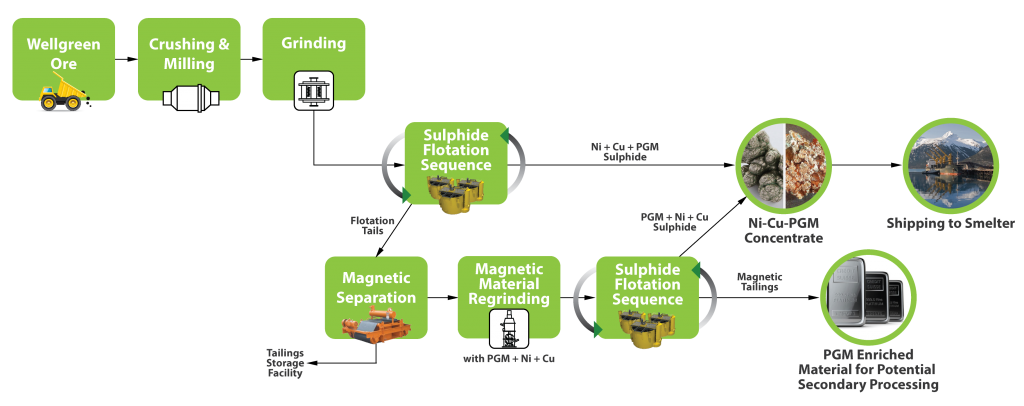

With recognition that a sizeable amount of the PGMs, particularly platinum, was not being captured in the sulphide flotation process because it was finer-grained and associated with the magnetic minerals magnetite and pyrrhotite, the Wellgreen team and its metallurgical consultants conducted subsequent testing to evaluate the benefit of adding a magnetic separation process to the flowsheet. Magnetic separation is a proven technology utilized in many operating Ni-PGM mines. The magnetic separation process was successful in capturing additional PGMs, nickel and copper through regrinding of a modest volume of magnetic material followed by conventional flotation, particularly in the Clinopyroxenite/Pyroxenite and Peridotite domains. This material is then combined with the main sulphide concentrate thus improving overall primary flotation recoveries. In addition, the remaining magnetic material may be amenable to additional secondary processing, potentially adding to the recovery of conventional flotation (see flowsheet below).

Figure 1 – Wellgreen Project Mineral Processing Flowsheet

As a result of the improved understanding of sulphide flotation on the different domains, the Company conducted additional test work on the lower grade Peridotite domain which had historically seen much less testing. These tests confirmed that increased recovery can be achieved in Peridotite following the same general process flowsheet with the use of flocculants, magnetic separation and a slightly finer grind size than the other two domains.

The recovery level estimates for the metals in each of the three metallurgical domains are based on recovery versus concentrate grade curves selected from the extensive batch tests and locked cycle tests for each domain completed on the project to date. As noted in Table 1, the highest recoveries are in the Gabbro/Massive Sulphides domain with very good recoveries also attained in the Clinopyroxenites/Pyroxenites and Peridotites. In addition, testing showed that recoveries were generally higher for locked cycle tests than the majority of batch tests due to the recycling of the process material, which simulates the actual process flowsheet from a mine.

Bench scale testing and locked cycle tests for Wellgreen demonstrate that conventional sulphide flotation methods can be used to produce a high-value bulk Ni-Cu-PGM concentrate. These mineral concentrates contain pentlandite as the main nickel mineral, chalcopyrite as the main copper mineral, along with the PGMs and gold included in the minerals sperrylite, merenskyite, sudburyite and lesser known minerals. Testwork has also demonstrated the possibility of producing high value separate Ni-PGM and Cu-PGM concentrates.

Future Metallurgical Test Work

The Company expects to carry out more detailed metallurgical testing in order to further refine the process flowsheet, evaluate recoveries based on the sequencing of material from the mine modelling process, quantify contributions from the rare PGMs and evaluate secondary processing options that may further improve PGM and base metal recoveries as part of Pre-feasibility level studies.

With the completion of the updated mineral resource estimate and metallurgical testing, Wellgreen Platinum will be working closely with its independent engineering firms on mine planning and scheduling as the final component of the 2014 PEA. The Company has been advised by its lead engineering firm that they expect to be able to provide the PEA assessments over the next 1-2 months, as well as completion of the full 43-101 technical report in Q4 2014.

About Wellgreen Platinum

Wellgreen Platinum Ltd. is a Canadian mining exploration & development company focused on the acquisition and development of platinum group metals (PGM) projects in politically stable, mining-friendly jurisdictions. One of the largest undeveloped PGM-nickel-copper deposits outside southern Africa or Russia, our 100% owned flagship Wellgreen project located in Canada’s mining-friendly Yukon Territory is 14 kilometres by all-weather road from the paved Alaska Highway leading to deep sea ports in Haines and Skagway, Alaska.

Wellgreen Platinum Ltd. has an experienced management team with a track record of successful large scale project discovery, development, operations and financing and is focused on advancing Wellgreen towards production.

Wellgreen Platinum Contacts:

Greg Johnson, President & CEO

1-888-715-7528

Chris Ackerman, Manager, Corporate Communications

1-604-569-3634

cackerman@wellgreenplatinum.com

Quality Assurance, Quality Control: The technical information disclosed herein was prepared under the supervision of John Sagman, P.Eng., Wellgreen Platinum’s Senior Vice President and Chief Operating Officer, and Mr. John Eggert, P.Eng ., President and Principal Minerals Processing Engineer with Eggert Engineering Inc., each of whom is a “Qualified Person” as defined in NI 43-101. In addition, Mr. Sagman has reviewed and approved the technical information contained in this news release. Mr. Sagman has verified the data disclosed in this news release and no limitations were imposed on the verification process. Mr. Sagman, P.Eng., reviewed in detail, with Mr. Eggert P.Eng., the various technical reports, confirmed detailed calculations and checked detailed batch / LCT test results to confirm these were transcribed correctly into the technical documents that this news release relies on. Other than as described below and in the Company’s annual filings (which are available at www.sedar.com), there are no known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources at this point of time.

Forward Looking Information: This news release includes certain information that may be deemed “forward-looking information”. Forward-looking information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. All information in this release, other than information of historical facts, including, without limitation, the timing of the 2014 PEA and Pre-feasibility level studies, the scale and potential of the Wellgreen project, the anticipated improvements to metal recoveries, engineering and mine planning, general future plans and objectives for the Wellgreen project, are forward-looking information that involve various risks and uncertainties. Although the Company believes that the expectations expressed in such forward-looking information are based on reasonable assumptions, such expectations are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking information. Forward-looking information is based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from the forward-looking information include changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, uncertainties inherent in metallurgical and mining studies, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, the Company’s ability to maintain the support of stakeholders necessary to develop the Wellgreen project, unanticipated environmental impacts on operations and costs to remedy same, and other risks detailed herein and from time to time in the filings made by the Company with securities regulatory authorities in Canada. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking information. For more information on the Company and the risks and challenges of our business, investors should review our annual filings which are available at www.sedar.com. Readers are cautioned not to place undue reliance on forward-looking information. The Company does not undertake to update any forward looking information, except in accordance with applicable securities laws.

Cautionary Note to United States Investors: This news release uses the terms “Measured”, “Indicated” and “Inferred” Resources in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards. United States investors are advised that while such terms are recognized and required by Canadian securities laws, the United States Securities and Exchange Commission does not recognize these terms. The term “Inferred Mineral Resource” refers to a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. These estimates are based on limited information and have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category of resource, such as “Indicated” or “Measured”, as a result of continued exploration. Under Canadian securities laws, estimates of an “Inferred Mineral Resource” may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of “Measured” or “Indicated Mineral Resources” will ever be converted into “Mineral Reserves” (the economically mineable part of an “Indicated” or “Measured Mineral Resource”. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

Previous Disclosure Regarding Mineral Resource Estimate: Readers are urged to review the Company’s news release dated July 24, 2014, and the related material change report dated August 1, 2014, wherein the Company announced its new mineral resource estimate. Each of these documents is available under the Company’s profile at www.sedar.com. The Company expects to file a technical report in respect of the new resource estimate in early September 2014.

“Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”